The process approach in management allows functionally oriented activities within a company to be systematically integrated, to build clear and understandable management task schemes, and to evaluate and optimize the resources utilized. One of the most significant advantages is the ability to measure processes in terms of added value and therefore set and monitor the level of efficiency.

A characteristic feature of the last decade, which is associated with corporatization, the revival of industrial production in the post-Soviet space, and economic growth, is the active interest in new technologies, including those in business management. Business owners, top managers, and middle management have realized the need for management based on a fundamentally different approach than that which existed under strict state regulation of industrial production. It would be incorrect to assume that the Soviet school of management was absurd and illogical, did not know management methods, or did not use them. In some cases, we can talk about the continuity and development of such methods.

However, the transition to market conditions put three key factors for business success (“quality,” “price,” “time”) at the forefront and demanded new approaches to management in both methodological and technical aspects, allowing companies to achieve competitive advantages in terms of product quality, business costs, and speed and quality of processes.

Process approach

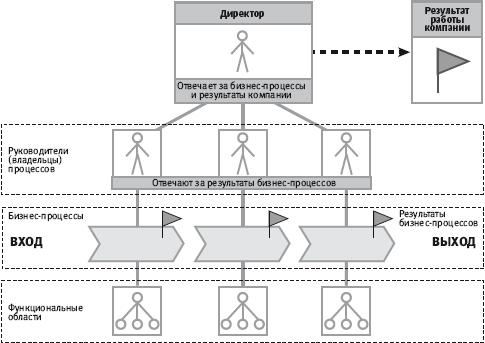

The process approach has become a revolutionary new stage in the development of management technologies for business systems. Managing from a process perspective allows for the systematic coordination of functional areas within a company’s operations, creating clear and understandable implementation schemes for management tasks, and evaluating and optimizing resources used. One of the most important advantages of this approach is the ability to measure processes in terms of added value and, consequently, set and monitor levels of efficiency.

The process approach has led to an understanding that the quality of a product is determined not by the number of product control procedures, but by the quality of organizing and executing business processes. This is reflected in the fundamentally new edition of the well-known international standard ISO 9001, the third edition of which espouses the process approach as the main doctrine for ensuring product quality.

It is worth noting that the term “quality assurance” has been removed from the title of the standard. This reflects the fact that the requirements specified in the third, “process-based” edition of ISO 9001, in addition to ensuring product quality, are also aimed at increasing customer satisfaction. The presence of regulated and formalized procedures allows for the management of response time, measuring and optimizing the speed of executing business processes. The main resource of a business, time, can be reduced by improving the internal structure of business processes and automating them using IT technologies.

The problem with building a process-based organization is the way to implement the idea. In conditions where there is not enough clear understanding of what constitutes a management system, what its structure is, and how it should be constructed, there is a substitution of concepts and the technical aspect takes center stage. That is, the choice, acquisition (creation), and implementation of management automation systems (MAS) based on IT technologies. A management automation system refers to a software package (SP) and hardware and technical base that provides the operation of that software package. Today, the market is filled with systems of various classes and price ranges, ranging from a simple set of software products for solving local management tasks, often only united by a common name, to world-class systems with a full set of deeply integrated functional modules.

However, analyzing and critiquing products available on the market is not the focus of this article and is the subject of separate studies. It should only be noted that widely advertised capabilities of management information systems (MIS) can lead the buyer (client) to the typical misconception that purchasing a software product is equivalent to purchasing a complete information management system, or at least the main step towards its creation. Thus, in practice, the focus shifts from building an information management system to choosing a tool. In a rough analogy, this is like buying a horse without a clear idea of what carriage it will be hitched to. To some extent, this misconception is also facilitated by the widely “advertised” abbreviations of management concepts such as ERP and MRP II, used for marketing purposes on software products.

The widely circulated software packages are conceptually oriented towards a specific model of building a management system, which is implemented through so-called reference models. Consulting companies representing a particular software package are objectively interested in selling the product(s) on which they earn a profit. Expecting optimal solutions for building a management system through external consulting alone is careless, if not naive. It seems reasonable to consider the practical aspects of building information management systems, assuming that MIS is only a software product used in building an efficient information management system, but far from a solution to all management organization problems. Regardless of its class and manufacturer, MIS can remain a relatively expensive set of technical and software tools, while an information management system can be a beautiful but unattainable dream.

Building an information management system

Where to start building an information management system?

The starting point should be understanding that management organization is one of the fundamental functions of a company, and it cannot be effectively implemented as an additional, episodic “burden” of the human resources department, labor and payroll department, ASUP department, or other departments.

Unfortunately, in most cases, enterprise management is built spontaneously, based on various, sometimes conflicting, regulatory documents, established traditions, experience, or intuition of managers at different levels without a unified concept and interconnection. As a rule, there is no understanding of enterprise management as a holistic system with division into elements (business processes), ordering, and interconnection of these elements.

Today it is already evident that someone should professionally deal with the organization of management in companies. The task of the management organization department (specialist) is to create a business model of the company, constant monitoring of the management system, and ensuring improvements. A one-time survey of the company and creating a business model with the involvement of a consulting firm allows for methodologically correct work, but does not guarantee long-term results in a dynamically developing business. Over time, new costs will be required to synchronize the created model with ongoing changes. The number of such iterations is directly related to the dynamics of the company’s development. This task should be addressed on a permanent basis by experienced staff business consultants in various functional areas of activity, who know the intricacies of business, its prospects for development, and modern management technologies well. It is understood that their role is not just to reflect changes but to manage changes actively, ensuring the continuity of management system improvements.

Creating a Business Model

Creating and managing a business model is not an end in itself or a tribute to fashion. It is a tool for effective business management, built on process and systems approaches. A business model is a combination of graphical and textual descriptions that allow for a precise understanding and simulation of the management process of an enterprise. The structure of a business model can be represented by three main components:

- Organizational model – the organizational structure of the enterprise and the roles played by employees in the management system.

- Functional model – the business processes and events that initiate these processes, and the output results.

- Information model – the scheme of information flows in the management circuit, built on the basis of the functional model.

Such a structure of the business model is considered the most successful, as it takes into account the integration of all elements of the business system (Figure 1). If there are changes in the organizational model, the impact of these changes on the functional model and, accordingly, on the information field (information model) must be assessed. Similarly, an assessment can be made for changes in other structural elements.

Figure 1. Structure of the business model

A systematic and comprehensive approach to monitoring the business model ensures balanced development and dynamic equilibrium of the management system.

Functional Model

It is advisable to begin developing a business model by creating a functional model of the business. This involves representing enterprise management as business processes (workflows) that transform input data into output data that is consumed by other processes or external consumers. The objective of this stage is to transform management “as is” into a process environment and, without delving into the details of specific operations, to identify macro-processes, outline the boundaries of these processes, define inputs and outputs, and establish the existing relationships between them at the event level.

The set of such macro-processes is fairly typical, although it has its own characteristics for different types of businesses. Typically, these include:

- customer operations;

- supplier operations;

- planning;

- production and inventory management;

- infrastructure management;

- project management;

- logistics management;

- quality management;

- accounting and control;

- financial management;

- human resources management;

- business risk management, and so on.

Identifying these and possibly other macro-processes will help define the logical boundaries of the business, identify main and supporting processes in relation to the core business. It is important to emphasize that “supporting” processes should not be equated with “secondary” processes.

Creating a functional model will make it possible to see the existing business management system and understand “how it happens” not on the level of fragmented information, numerous regulatory documents, assumptions, and guesses, but as a unified, formalized management scheme.

Organizational Model

The next step is the development of the organizational model based on the organizational structure of the enterprise. It should be noted that the organizational model should not be viewed as a graphical reflection of the staff schedule, but as a system of elements united by management relationships and functions. The organizational model should include both formally existing structural units and groupings of structural units by target criteria (standing committees, project groups, councils, committees, etc.).

An important stage of the modeling process is establishing integration links between the functional and organizational models, i.e. “tying” the elements of the organizational model to the macro-processes of the functional model. Having identified “how it happens,” it is necessary to determine “who does it.” This stage of building the business model provides an overview of the role of organizational units in business management, their redundancy, duplication, insufficiency, or ambiguity.

Information Model

The most routine process is the construction of an information model, i.e. the identification of information in the existing management system and the creation of a diagram of information flows circulating through all communication channels.

The information model should be built on the basis of the functional model, i.e. with reflection of document circulation linking macro-processes at the event level. This will allow separating the main (critical for business) information flows in the management system (information flows of the first level) from the information flows within macro-processes (second level flows).

It is erroneous to try to build an information model based on the organizational model. In this case, a large number of documents circulating between structural units will be involved in the attention zone of developers, regardless of the level and value for business management, i.e. all “information noise”, which is quite difficult to sort out.

Thus, the proposed methodology for creating a business model “as is” allows identifying the main thing in business management at this stage and “cutting off everything superfluous” – non-essential processes, structural units, and irrational information flows. This approach significantly reduces the time for pre-project examination and ensures concentration of resources on the main directions of business. Analysis of objects left outside the contour of the created business model “as is” can be carried out in the future and already in the context of the business model “as will be”.

Building a “as will be” model is a complex and multifactorial problem that cannot be covered in a journal article, so it is advisable to touch on only some practical aspects of creating an information management system using a modern management automation system.

Concept of management

When making a decision about automating management, it is important to clearly define:

- What management concept will be the basis of the future system;

- Which business processes need to be changed and automated in the context of this concept;

- How well the needs of the created management information system are satisfied by the software products that exist in the enterprise or are available on the market.

When defining the management concept, it is advisable to rely on proven management methodologies used in the world. The chosen management concept is the logic by which the functional model “as is” is transformed into the functional model “to be” and will determine the approach to the functionality of the software complex in the future.

Today, systems built on the MRP II/ERP concept have become a logical, complete, and deeply integrated methodology for industrial production. These systems implement a structured planning, control, and operational information provision system for decision-making. Relying on proprietary developments or local domestic products is not always justified because it carries significant risks and functional disadvantages. This does not mean that the software products available in the enterprise should be excluded from the management system. The functionality offered by world-class systems may be excessive for the scale of the business and its development prospects. In practice, it is almost always possible to integrate large software complexes and local products that meet the accepted business model. One option for such a solution may be a well-established management task at the enterprise built on a local product that fully meets the business needs and is compatible with a world-class system, providing regular data translation.

Excessive functionality is not always justified. This often applies to powerful budget management or accounting systems implemented in Western systems, the configuration and support of which can be quite complex and may result in the opposite effect. It is much more effective not to waste time and effort on re-automating sections that are already working on lower-level systems, but to think through the integration of several management information systems within the framework of a common ideology and business model.

The transition from the “as-is” model to the “to-be” model and the implementation of an automated management system should be carried out gradually and carefully, taking into account that any organizational miscalculations in the prism of radical changes can have a negative impact on the company’s operations, its development pace, and the overall effectiveness of the business. The actions of the reformers are similar to medical practice, where the sacred principle of “do no harm” is known to apply.

Priorities in the reorganization of business processes should be set based on the perspective of maximizing economic effect. Therefore, it makes sense to include in the first phase of management automation those business processes that provide significant advantages in managing the main direction of the business. For an industrial enterprise, this would primarily include production and logistics modules. Fragments of such a solution are presented in Fig. 2.

Fig. 2. Fragment of the solution for phased implementation of an automated management system based on an ERP-class software complex.

Conclusion

It would be naive to claim that the implementation of the process approach, like any other management technology, will give the enterprise a decisive strategic advantage over its competitors. It is clear that even if this method has been mastered earlier and better than others, it is only a temporary advantage that will disappear as soon as similar work is carried out by the competitor. In the end, it is a matter of time and money.

Nevertheless, a year or two of advantages in efficiency are worth a lot if you are not in a catching-up position. But most importantly, business processes allow a significant reduction in the competence level requirements for most employees when productivity increases sharply, thanks to the specialization of the performers’ actions. This is similar to the transition to Ford’s conveyor in terms of formalizing management operations. In conditions of a shortage of qualified personnel, this is a cheaper solution than retraining and the constant risk of losing trained personnel to a competitor.

The presence of qualified in-house specialists in the development of the management system is extremely important, who will be able to maintain the management system in an up-to-date state, act as guarantors of the integrity of the system and its focus on the overall result. They will be in demand after external consultants leave. Investing money in expensive projects, such as ERP implementation, without creating an internal qualified service responsible for the management system’s operation, looks very risky.